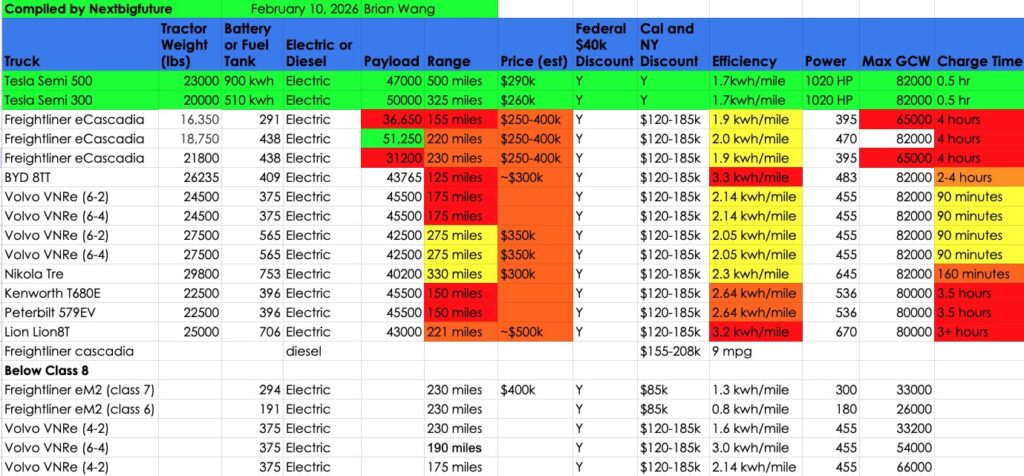

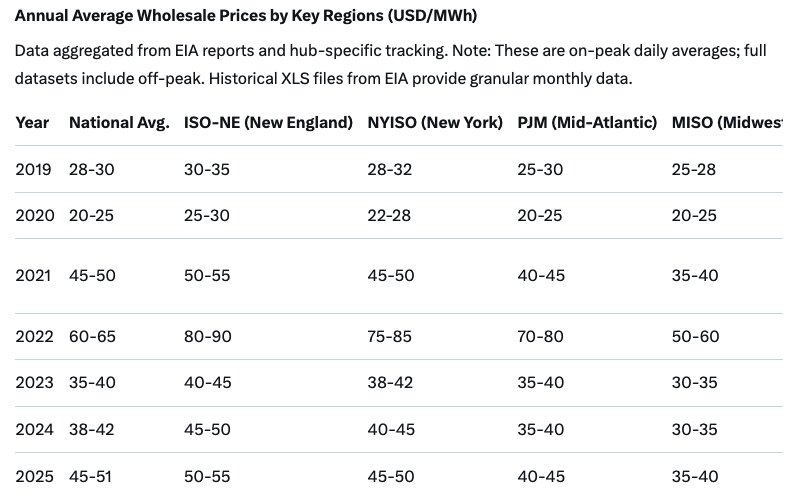

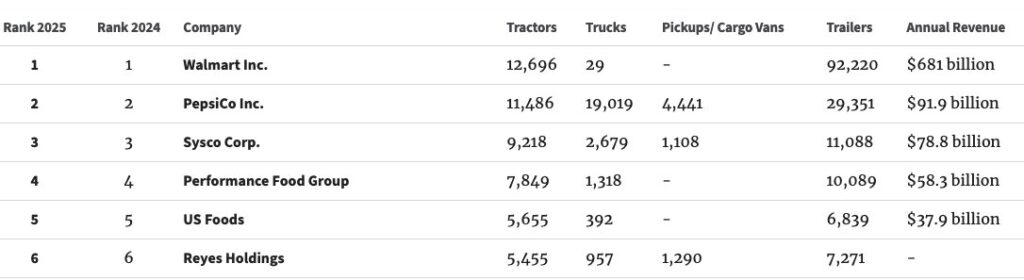

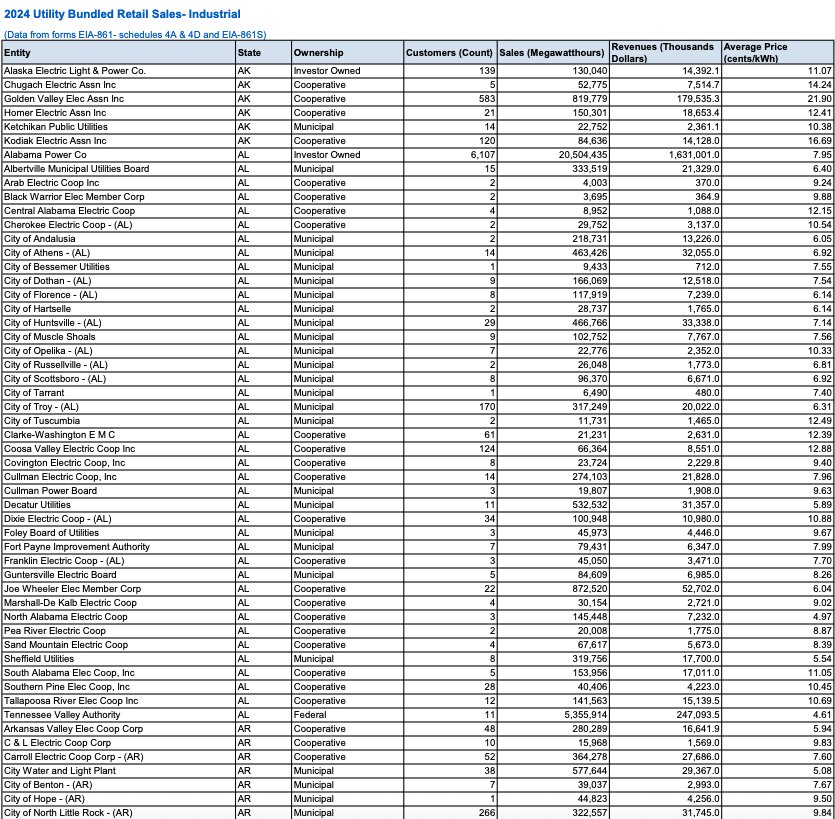

Forbes Senior Editor Alan Ohnsman repeats his mistake that electricity prices have tripled. He compared Tesla electricity price guarantee around wholesale and industrial electricity and then switched to residential electricity prices. He also claimed that Tesla would sell the Semi for $400,000 when the announced prices were $260,000 for the 325 mile range and $290,000 for the 500 mile range Semi. He claimed there are no savings for electricity powered Semi versus diesel trucks when Pepsi and DHL are showing $18,000-23,000 in annual savings per truck by using electricity. This was even when Pepsi sited the depot in higher cost California. DHL has some lower mileage for $10,000 per year savings in some cases.

3-5 year payback periods including upfront costs (~$230k-290k per Semi vs. ~$180k diesel). There are state and federal grants that reduce the cost of the vehicles.

PepsiCo operates ~50+ Tesla Semis and focuses on regional routes (100-450 miles). In April 2025, PepsiCo expects to save close to $1 million in fuel costs to charge its fleet of 50 semitrucks located at its bottling facility in Fresno, California, according to an April 28 press release. PG&E increased charging capacity for the food and beverage company’s site from 3 megawatts to 4.5 megawatts. Flex Connect enables PepsiCo to increase its charging capabilities from 30 trucks to its full fleet of 50 EV trucks, helping maintain its operation with ease. Combined, Frito-Lay and Pepsi, which is part of PepsiCo’s entity, operate 1,500 electric vehicles of all sizes, not necessarily just semitrucks. PepsiCo has more than 70,000 fleet assets in North America, Fleet Sustainability Manager Emily Conway said during a February webinar in 2022.

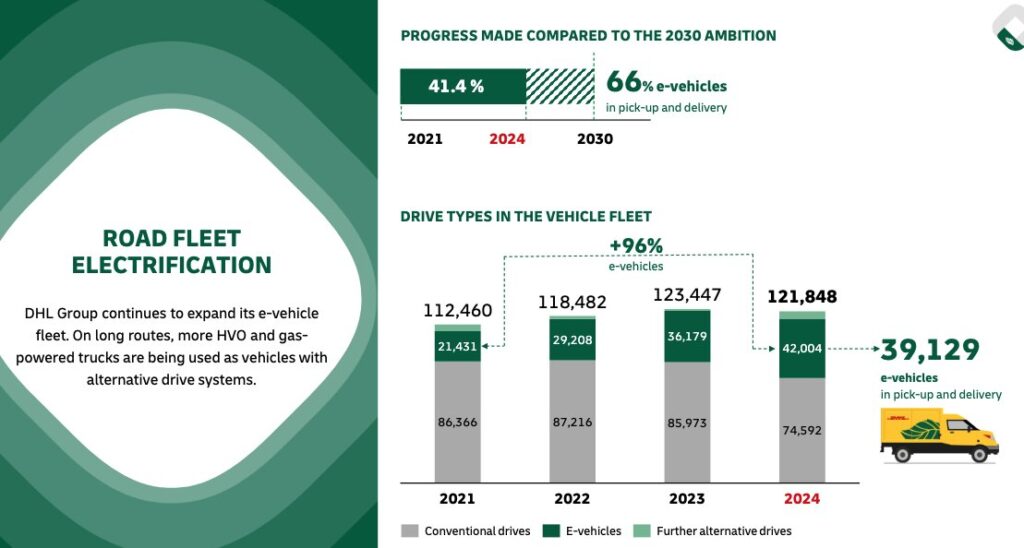

DHL plans to add more Tesla Semis to its operations in 2026, part of long-term efforts to reduce its emissions to zero by 2050. DHL plans to make two-thirds of its fleet EVs by 2030, and those vehicles already make up over 41% of that breakdown.

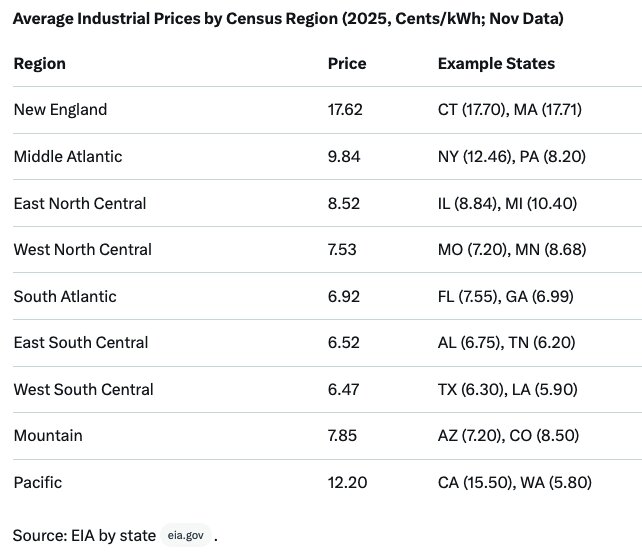

Industrial prices are retail rates paid by large manufacturers and facilities, often lower than residential/commercial due to high volume and negotiated contracts. They include transmission/distribution fees on top of wholesale. EIA tracks by state and sector; national averages rose steadily, influenced by wholesale trends but buffered by long-term contracts.

New England has high prices but those are small states and you would not put a charging depot in them. Any deliveries would be made with charging outside and then you drive 200 miles and 200 miles out.

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.