On the back of market rallies over the last few weeks, the Nasdaq is now up just over 1% year-to-date. The S&P 500? Flat. The Dow Jones Industrial Average? Down 0.6%.

Inflation is cooling, with the year-over-year rate in April at 2.3%, the lowest since February 2021.

But the numbers tell one story, and how Americans experience inflation tells another. And national statistics can blanket over a more complicated landscape on the local level.

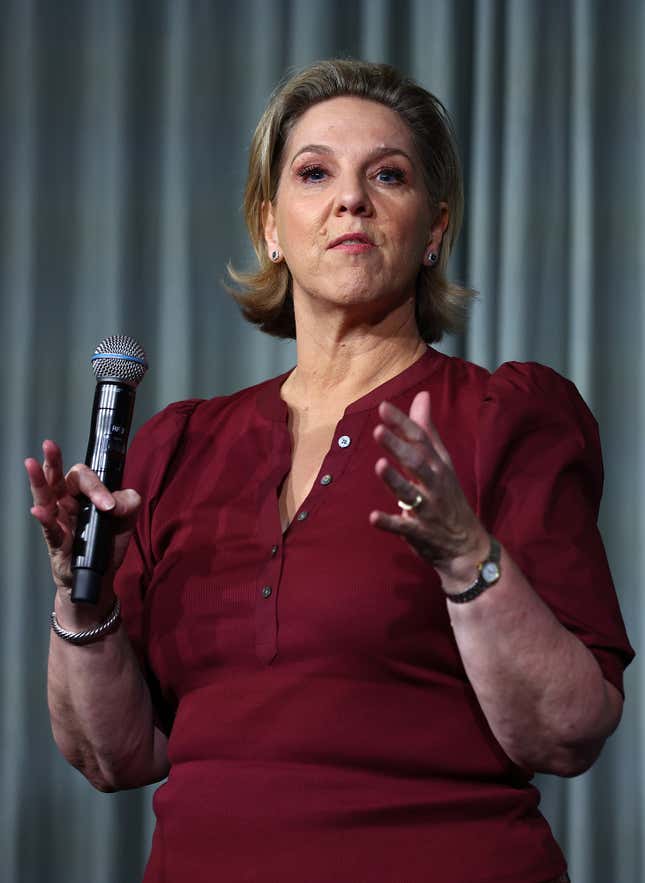

Robyn Denholm, the chair of Tesla’s (TSLA) board of directors, sold nearly $200 million worth of Tesla stock in the past six months, per an New York Times analysis of recent SEC filings.

U.S. stocks soared Monday after Washington and Beijing struck a surprise deal to dramatically cut tariffs, marking a rare moment of clarity and good news in an otherwise volatile environment.

Inflation cooled more than expected last month, with consumer prices rising 2.3% year-over-year in April, down from a 2.4% annual rate in March.

The April Consumer Price Index (CPI) report, released early Tuesday, marked the lowest annual inflation rate since early 2021 and the third consecutive month of deceleration, edging closer to the Federal Reserve’s recently reiterated target of 2%.

Coinbase is set to join the S&P 500 — a milestone moment not just for the company but arguably for the American economy itself.

The $52 billion company, which runs the largest publicly traded crypto exchange in the U.S., will replace Discover Financial Services (DFS) following Discover’s looming acquisition by Capital One (COF), S&P Global said late Monday.

The Federal Reserve has been playing a waiting game for months. A lot has changed this week. And the Fed will probably just keep playing the waiting game.

Federal Reserve Chair Jerome Powell is warning that near-zero interest rates are likely to be a thing of the past.

During his opening remarks at the Federal Open Market Committee 2025 review on Thursday, Powell indicated that longer-term interest rates are to remain higher due to economic volatility.