Brian and Cern Basher had a deep dives into why Tesla robo-trucking (autonomous electric semis) may be an even bigger profit driver than robo-taxis:

Cern adapted his robotaxi financial models for trucking.

Tesla’s robo-trucks are overlooked but could be as big or bigger than robo-taxis in revenue, profit, and market value.

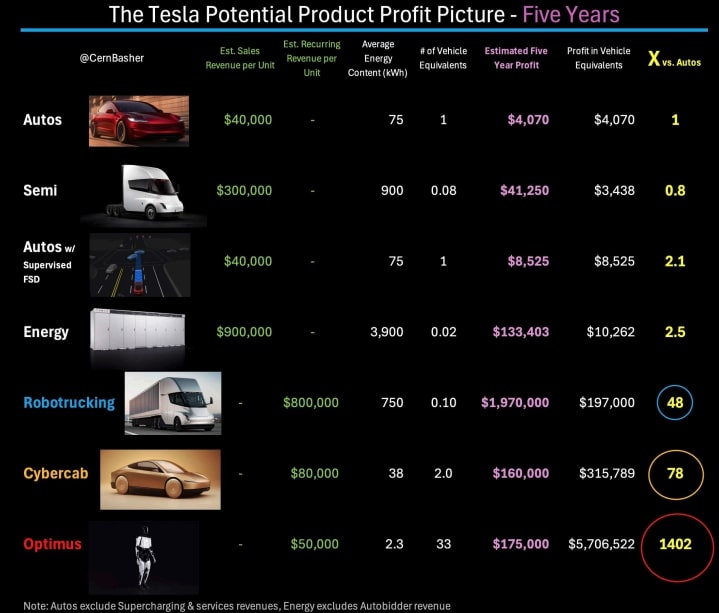

Profitability Comparison:

$40k Tesla car = ~$4k profit per 5 years.

Semi = ~10x profit of a car.

Energy products = ~2.5x a car.

Robo-taxi = ~78x a car.

Robo-truck = ~48x a car (battery adjusted).

Optimus (robot) = “off the charts.”

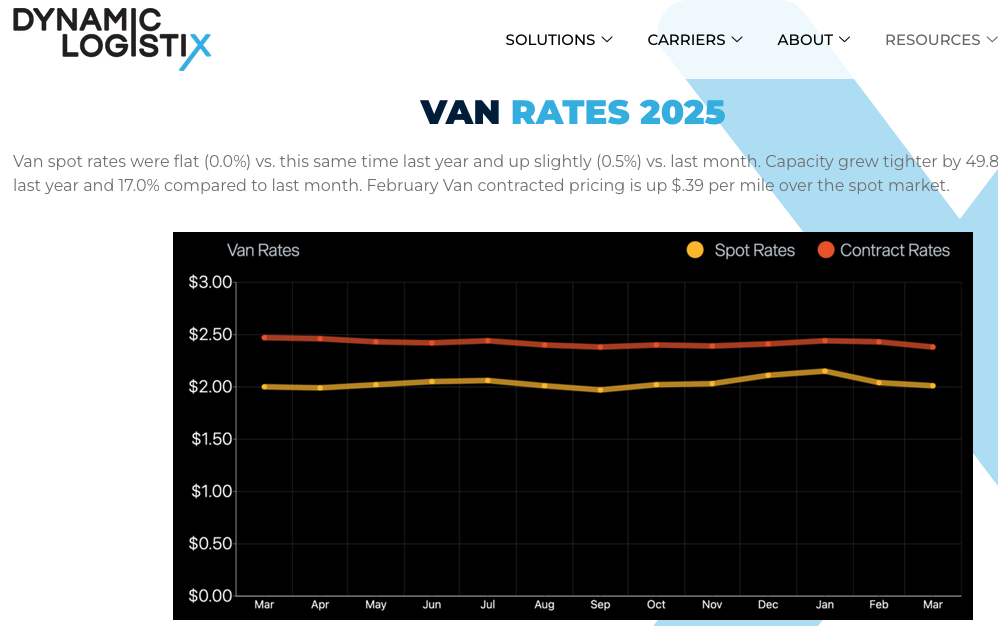

Utilization Edge:

Robo-taxis: limited to ~35–55% utilization (8–13 hrs/day).

Robo-trucks: can hit 80–90% (19–22 hrs/day) since no driver rest required.

Trucks run ~1,000 miles/day vs. robo-taxi’s ~100–300 miles.

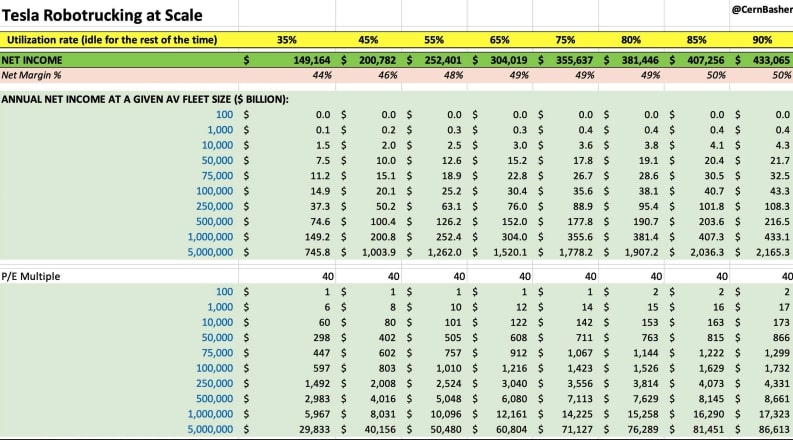

Revenue & ROI:

Each truck could earn $770k–$870k/year at high utilization, with ~$380k–$430k net annual profit.

Payback: under a year, even at conservative numbers.

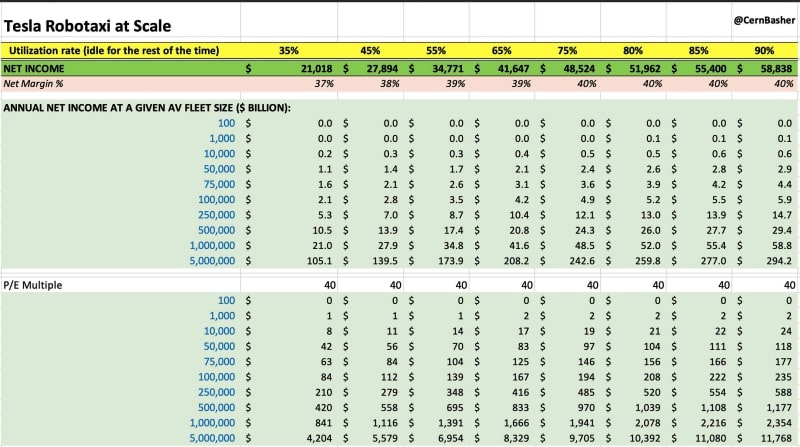

Fleet Scaling:

50k robo-semis = ~$19B annual profit → ~$763B market cap.

500k robo-taxis needed to match that output.

Market Size:

Trucking is an $800B-$1T U.S. industry, 4x larger globally. Could even disrupt rail freight.

Advantages: Removes driver costs, slashes fuel/maintenance, electrifies logistics, reduces turnover and emissions.

Synergies: Pairing robo-trucks with Optimus bots, Megapacks, and Tesla depots = autonomous logistics ecosystem.

Challenges: Charging infrastructure (mega-chargers), regulations (CA/Northeast bans still hurdles), but costs and economics so strong rollout feels inevitable.

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.